do you pay taxes on a leased car in texas

When you buy a vehicle you must pay sales tax on the total value of the car. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Area Code.

. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local. In this case renting would make you 1261 richer. Youll never pay more than 099 on any given transaction.

There is no personal property tax on leased vehicles in Virginia. Leasing vehicles are taxable to the leasing company due to their income. The tax area code for the location.

All leased vehicles with a garaging address in Texas are subject to property taxes. To ensure that Shopify Tax is sustainable and affordable to merchants of all sizes the fee is also capped at 099 per transaction. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

Do I have to pay taxes on a leased car. Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront. While you wont necessarily pay the entire amount.

Arkansas taxes are due Monday Oct. At end of lease we purchased vehicle for 15k. In some states such as Oregon and New Hampshire theres no sales tax at all.

No tax is due on the lease payments made by the lessee under a lease agreement. Instead sales tax will be added to each monthly lease. If you lease a car as a private individual under a personal lease you will have to pay 20 VAT value-added tax.

All property in Texas must be taxed as. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing. The lessee is not liable for property taxes on the vehicle.

Leased a car in California and moved to Texas about halfway through lease. In other states such as Texas youll have to pay a flat fee each year. The sales tax for cars in Texas is 625 of the final sales price.

The tax area code is used in conjunction with a tax group code field and the Tax Liable field to find the necessary. Again its important to. Depending on where you live leasing a car can trigger different tax consequences.

Yes in Texas you must pay tax again when you buy your off-lease vehicle. Any tax paid by the. For example in Texas youll have to pay 90 a year in property tax for a car thats valued at 20000.

The monthly rental payments will include this. When we went to transfer the title they charged us sales tax on 20k. Technically there are two separate transactions and Texas taxes it that way.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5. A person who purchases a motor vehicle in Texas owes motor vehicle sales tax. KAIT - For those who have not paid their personal property or real estate taxes time is running out.

11 hours agoMarginal Rates. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any. In most states you only pay taxes on actual lease.

There are some available advantages to leasing a vehicle in a business name please. In most cases yes youll still have to pay sales tax when you lease a new car but this could vary depending on where you live. When you lease a car in most states you do not pay sales tax on the price or value of the car.

This means you only pay tax on the part of the car you lease not the entire value of the car. A Texas resident a person domiciled or doing business in Texas or a new Texas resident who brings.

Do Auto Lease Payments Include Sales Tax

Mini Clubman Lease Finance Prices Austin Tx Mini Of Austin

Ford Lease Vs Buy Comparison Katy Tx

Is It Best To Own Or Lease Your Business Vehicle

Bmw X2 Lease Incentives Prices Austin Tx

Car Insurance When Leasing Vs Buying Direct Auto Insurance

Understanding Tax On A Leased Car Capital One Auto Navigator

Sales Tax On Cars And Vehicles In Texas

Bmw X3 Lease Deals Austin Tx Bmw Of Austin

Tax On Leased Bmw In Texas Lessee S Affidavit For Motor Vehicle Use Other Than Production Of Income Ask The Hackrs Forum Leasehackr

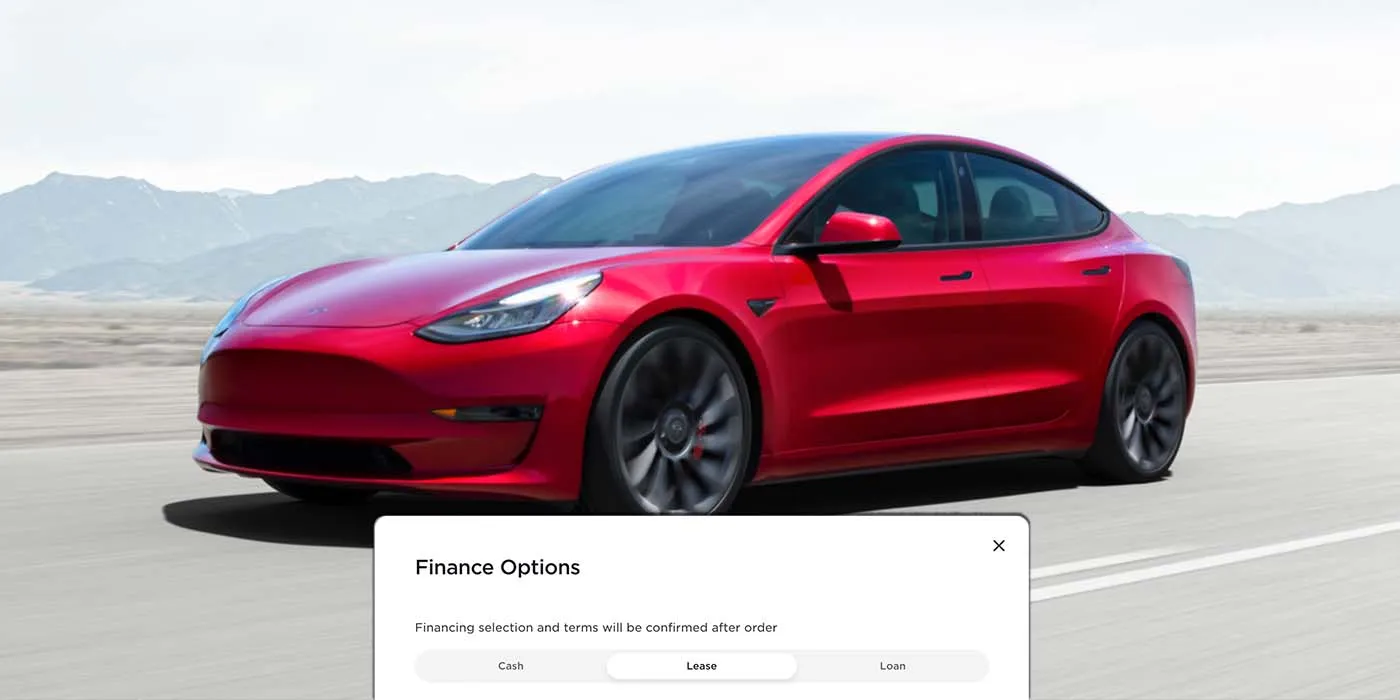

How Much Is A Tesla Lease In 2022 Electrek

What To Do When Your Car Lease Ends Usaa

Lease Buyout Title Transfer Process Cartitles Com

Do Auto Lease Payments Include Sales Tax

Bmw 5 Series Lease Deals Austin Tx Bmw Of Austin

Move Your Leased Car Out Of State Blog D M Auto Leasing

New Illinois Sales Tax Law Lowers The Cost Of Leasing A Car Chicago Tribune

2022 Volvo S60 Lease Deals 499 Month Or Less Grubbs Volvo Cars